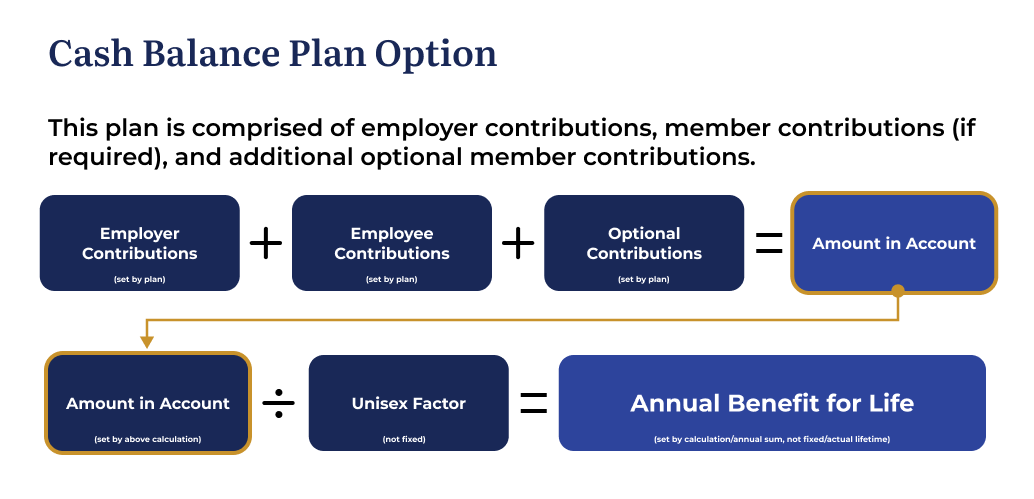

Flowchart detailing a Cash Balance Plan Option. The first row details the calculation for the Amount in Account: Employer Contributions plus Employee Contributions plus Optional Contributions equals Amount in Account. The second row shows the calculation for the Annual Benefit for Life: Amount in Account divided by a Unisex Factor equals Annual Benefit for Life.

Cash Balance plan has many characteristics of a defined contribution plan in that it is account based.

The cash balance account is comprised of money the employer funds into the account, the money the employee (if required) funds into the account, and any money the employee optionally contributes to the account. Unlike a pure defined contribution plan, the account does not make or lose money with the market, rather the account only makes money at the regular interest rate as set by the PA Municipal Retirement Board of Trustees.

How is a cash balance plan funded?

- Employer contributions

- Employee contributions (required/optional)

- Credited interest based on PMRS board